Spain’s eInvoicing: a country-specific guide

Il Webinar fa parte del Programma Tematico:

Navigating eInvoicing worldwide: country profiles and expert insights (2025)

Descrizione del Webinar

Join us for an insightful webinar on the current landscape of eInvoicing in Spain. We’ll explore recent regulatory developments, key implementation timelines, and their impact. Whether you’re a business leader, finance professional, or policy stakeholder, this session will provide valuable updates and practical guidance on navigating Spain’s evolving digital invoicing framework.

The webinar is held in English.

Il webinar illustra lo stato attuale della fatturazione elettronica in Spagna, approfondendo gli ultimi aggiornamenti normativi, le principali scadenze previste per l’implementazione e le relative implicazioni operative. Nel corso del webinar vengono forniti aggiornamenti essenziali e indicazioni concrete per orientarsi in un contesto digitale in continua evoluzione.

Il webinar si tiene in lingua inglese.

Domande chiave

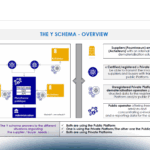

- What is the current state of e-invoicing in Spain., and how does it compare to global trends?

- How are Spanish businesses preparing for and reacting to the shift toward e-invoicing?

- What are the main drivers behind e-invoicing adoption in the Spain?

- What steps can companies take now to prepare for wider adoption of e-invoicing in the future?

- What are the expected future regulatory developments for e-invoicing in Spain?

- Qual è lo stato attuale della fatturazione elettronica in Spagna?

- Come stanno reagendo le aziende spagnole al passaggio verso la fatturazione elettronica?

- Quali sono i principali fattori che guidano l'adozione della fatturazione elettronica in Spagna?

- Quali passi possono compiere ora le aziende per prepararsi a un'adozione più ampia della fatturazione elettronica in futuro?

- Quali sono gli sviluppi normativi attesi in materia di fatturazione elettronica in Spagna?

Relatori

Marcos Álvarez Suso

Senior Tax Legal advisor, Spanish Tax AuthorityHe has been working Spanish Tax Administration for 25 years in different offices of the tax administration in Barcelona and Madrid in the following areas: combating tax crimes, Tax auditing, Member of the regional administrative tax court in Madrid, Tax collection, and specially VAT. In the course of these tasks he’s been heading since October 2009 till April 2022 the Deputy Direction for Legal Assistance in the Tax Auditing Central Department in Madrid.Vicedirezione per l'Assistenza Legale nel Dipartimento Centrale di Revisione Fiscale di Madrid.Ha lavorato per 25 anni nell'Amministrazione Fiscale Spagnola in diversi uffici dell'Amministrazione Fiscale di Barcellona e Madrid nei seguenti settori: lotta ai reati fiscali, revisione fiscale, membro del Tribunale Amministrativo Tributario Regionale di Madrid, riscossione delle imposte e soprattutto IVA. Nell'ambito di queste mansioni, dall'ottobre 2009 all'aprile 2022 ha diretto la Direzione Vicaria per l'Assistenza Legale del Dipartimento Centrale di Revisione Fiscale di Madrid.

Javier Hurtado Puerta

Senior Tax Inspector, Spanish Tax AuthorityTwice Deputy Director in Tax Control Dept (1999 - 2004 and 2012 - 2018) Head Director for Tax Control in Spanish Tax Agency (AEAT) (2018 - 2024). Bachelor´s degree in Law. 32 years of experience in Tax Administration. In last 4 years has gained Expertise in E-reporting for SME and avoiding Sale Supression Software. Promoter and supporter of VERI*FACTU project. Frequent speaker in events of New environment for invoicing control and E-invoicing in Spain.Consulente legale fiscale senior Due volte vicedirettore del dipartimento di controllo fiscale (1999 - 2004 e 2012 - 2018) Direttore responsabile del controllo fiscale dell'Agenzia fiscale spagnola (AEAT) (2018 - 2024). Laurea in giurisprudenza. 32 anni di esperienza nell'amministrazione fiscale. Negli ultimi 4 anni ha acquisito esperienza nell'E-reporting per le PMI e nell'evitare il software di soppressione delle vendite. Promotore e sostenitore del progetto VERI*FACTU. Relatore frequente in eventi sul nuovo ambiente di controllo della fatturazione e sulla fatturazione elettronica in Spagna.

Siamo a tua disposizione per informazioni e assistenza

Martina Vertemati

Acquisti e abbonamenti Da Lunedì al Venerdì, dalle 09 alle 18

Alessia Barone

Assistenza Da Lunedì al Venerdì, dalle 09 alle 18Scopri altri contenuti di International Observatory on Electronic Invoicing

Aggiungi in Agenda

Scegli la modalità di partecipazione